Refresco reports strong Q2 2021 results

Refresco, the world’s largest independent bottler for retailers and A-brands in Europe and North America, publishes the second quarter and half-year 2021 results of Refresco Group B.V.

Refresco, the world’s largest independent bottler for retailers and A-brands in Europe and North America, publishes the second quarter and half-year 2021 results of Refresco Group B.V.1

Q2 2021 Highlights

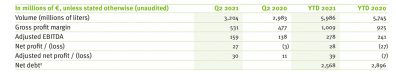

- Total volume was 3,204 million liters (Q2 2020: 2,983 million liters).

- Gross profit margin was €531 million (Q2 2020: €477 million).

- Adjusted EBITDA amounted to €159 million (Q2 2020: €138 million).

- Cash and cash equivalents at the end of Q2 2021 were €504 million (June 30, 2020: €314 million).

- Announced acquisition of HANSA-HEEMANN, a major German mineral water and CSD company, on July 8, 2021.

- Announced agreement with The Coca-Cola Company to acquire three of its production locations in the US, on August 3, 2021.

Half-year 2021 Highlights

- Total volume was 5,986 million liters (YTD 2020: 5,745 million liters).

- Gross profit margin was €1,009 million (YTD 2020: €925 million).

- Adjusted EBITDA amounted to €278 million (YTD 2020: €241 million).

Key figures

CEO Refresco, Hans Roelofs commented:

“We are pleased to report a strong performance in the second quarter of 2021. We have been able to accelerate our growth in volume and profitability this quarter, ending the first six months of 2021 with good results. We have strengthened the business organically by growing along with our customers, specifically in Contract Manufacturing. As we move into the second half of the year, we are facing increasing cost pressure on commodities and transportation, with higher inflation levels across all regions in which we operate.

On July 8, 2021, we announced the acquisition of HANSA-HEEMANN, a major German mineral water and CSD company. This acquisition will allow us to further improve our operational excellence, diversify our business and product offering, and will enable us to offer nationwide coverage to German retailers. With its five production sites spread across Germany, this acquisition is highly complementary. We look forward to welcoming HANSA-HEEMANN to Refresco, pending regulatory approval.

On August 2, 2021, we closed the acquisition of SEBB with one production site in Dade City, Florida, US. The acquisition expands our incubation capabilities for Contract Manufacturing customers looking for flexibility as they launch new, complex and innovative products. As their need for production capacity increases, customers will be able to leverage our existing footprint across North America.

On August 3, 2021, we announced that we have entered into an agreement with The Coca-Cola Company to acquire three of its production facilities in the United States, pending regulatory approval. The ongoing trend of A-brands outsourcing their production capabilities continues to provide opportunities for us as an independent beverage solution provider. With manufacturing and supply chain being at the heart of our business, the acquisition of three Coca-Cola facilities in the US is another step forward in our growth strategy.

With these strong financial results, our well-balanced customer base across Europe and North America, and our robust M&A approach, we continue to pursue our ambition of Our Drinks On Every Table.”

Please download the full report under https://bit.ly/3lSGAi8

1All values are rounded to the nearest million unless otherwise stated.

2Net debt as at June 30, 2020 includes €117 million shareholder funding; in Q4 2020, the shareholder loan plus accrued interest have been converted into equity.