China hot drinks sector set to surpass USD 48 billion in 2026, predicts GlobalData

Despite the brewing geopolitical, economic, and health crises, China’s hot drinks sales are set to increase, as consumers trade up to higher-quality products. The introduction of innovative and customised tea, coffee, and plant-based hot drinks is bolstering the market growth.

Despite the brewing geopolitical, economic, and health crises, China’s hot drinks sales are set to increase, as consumers trade up to higher-quality products. The introduction of innovative and customised tea, coffee, and plant-based hot drinks is bolstering the market growth. As a result, the China’s hot drinks market is set to register a compound annual growth rate (CAGR) of 6.1 % from CNY 231.4 billion (USD 36.2 billion) in 2021 to CNY 311 billion (USD 48.6 billion) in 2026, says GlobalData, a leading data and analytics company.

GlobalData’s report, ‘Chinese Hot Drinks – Market Assessment and Forecasts to 2026’, reveals that while tea remains the mainstay, the coffee culture is growing owing to the evolving lifestyles and preferences of urban consumers. The market growth will be primarily driven by the hot coffee category, which is set to register the fastest value CAGR of 6.5 % during 2021-2026. The category will be followed by other hot drinks and hot tea with a CAGR of 6.2 % and 6.0 %, respectively, over the forecast period.

Naveed Khan, Consumer Analyst at GlobalData, says: “The stringent COVID-19 lockdowns in Beijing, Shanghai and in the Hainan province have undermined the on-premise sales of hot drinks. However, consumers are treating themselves to higher quality tea and coffee at home. The growing demand for the new consumption experiences among the urban youth, and the introduction of new brew styles and flavours by international and homegrown companies are powering the growth of the hot coffee category in China.

“Hot tea, the largest category by value sales, continues to expand as new Chinese-style teas, such as yellow tea and scented tea, are gaining traction. The health concerns due to the pandemic are spurring the demand for herbal drinks that are perceived to improve immunity and overall health and wellness.”

According to the report, ‘convenience stores’ was the leading distribution channel in the Chinese hot drinks market in 2021, followed by hypermarkets & supermarkets, and e-retailers. Nestlé, China Tea, and Zhejiang Xiangpiaopiao were the top three companies in the fragmented Chinese hot drinks sector in value terms in 2021, and Nescafe and U.Loveit were the leading brands.

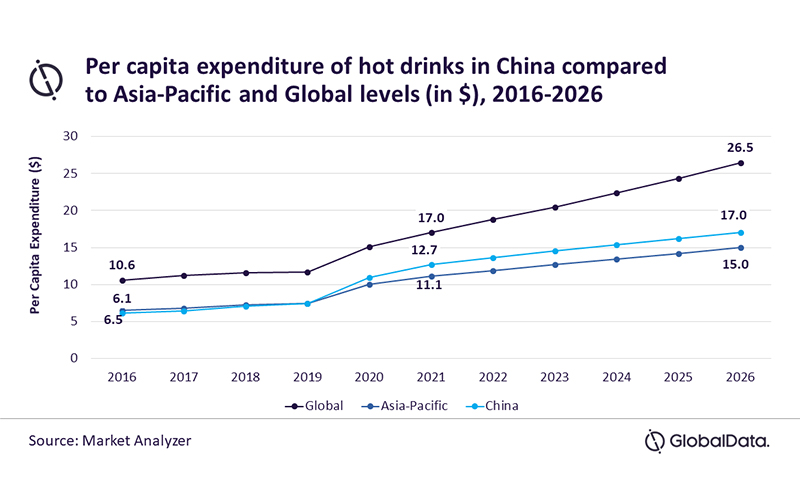

The per capita expenditure (PCE) on hot drinks in China increased from USD 6.5 in 2016 to USD 12.7 in 2021, surpassing the regional average at USD 11.1, but lagging the global level at USD 17.0. China’s PCE on hot drinks will surge to USD 17 in 2026.

Khan concludes: “Multinational and local companies are launching new products with innovative marketing strategies to develop new consumption occasions and expand their base. They are targeting young consumers, who are eager to experiment with innovative brew styles and flavours. However, the strict pandemic control measures, economic slowdown, and political standoff over Taiwan may slowdown the hot drinks sector’s growth momentum in the intermediate term.”