Refresco continues to deliver on buy and build and organic volume growth in Q2 2017

On July 25, 2017, Refresco announced the signing of a definitive agreement with Cott to acquire Cott’s bottling activities for $ 1.25 billion, creating the world’s largest independent bottler with leadership positions in Europe and North America.

Acquisition of Cott’s bottling activities

On July 25, 2017, Refresco announced the signing of a definitive agreement with Cott to acquire Cott’s bottling activities for $ 1.25 billion, creating the world’s largest independent bottler with leadership positions in Europe and North America. Cott’s bottling activities consist of 24 production sites in North America and 5 in the UK. It is a business with 2016 revenues of $ 1.7 billion[1], adjusted EBITDA of $ 136.5 million[2] and strong cash flow. The acquisition anticipates the expected retail brands market growth in the US driven by the expansion of hard discounters, expanding footprint of online retailers and macro factors enabling retail brands growth. The acquisition has significant synergy potential of around € 47 million. It will be more than 5 % earnings accretive already in the first full year of consolidation and considerably higher in the second and third year. The acquisition will be fully financed with debt. The company intends to issue € 200 million in new shares at the earliest opportunity. The transaction is expected to close in the second half of 2017.

Q2 2017 Highlights[3]

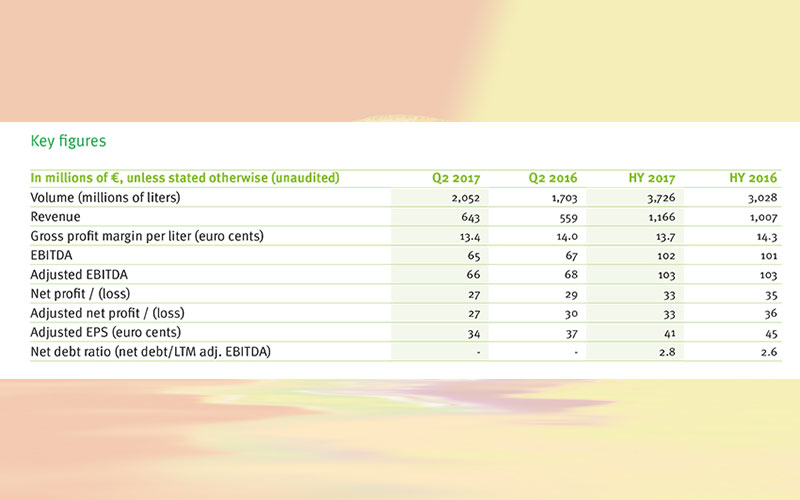

- Volume increased 20.5 % to 2,052 million liters. Organic volume growth was 2.8 %.

- Contract manufacturing volume increased to 37.7 % of total volume mainly driven by acquisitions.

- Gross profit margin per liter amounted to 13.4 euro cents in line with the expected impact of last year’s acquisition in the US (Q2 2016: 14.0 euro cents). Like-for-like gross margin per liter was 13.9 euro cents.

- Adjusted EBITDA amounted to € 66 million (Q2 2016: € 68 million).

- Adjusted EPS was € 0.34 (Q2 2016: €0.37).

CEO Refresco, Hans Roelofs:

“In July we announced the acquisition of Cott’s bottling activities transforming Refresco into the world’s largest independent bottler. In combining the two companies we create nationwide coverage in the US – the largest single soft drinks market globally – while adding significant capacity and extending our broad product portfolio in the UK. This acquisition lies at the heart of our buy & build strategy and is a perfect fit with Refresco’s current activities. It taps into the expected private label growth in the US enabling us to support further growth of our core customers and it creates a US national platform for contract manufacturing. We look forward to presenting this exciting new development to shareholders for their approval at the Extraordinary General Meeting on September 5, 2017.

“Looking back at the second quarter results we are pleased to report strong volume growth in Europe and the US driven by acquisitions and organic growth. On a like-for-like basis volume in retail brands remained stable and contract manufacturing for A-brands was up double digit. Gross profit margin per liter was in line with our expectations. Volume fluctuations in the quarter and significant startup costs of recently installed production lines affected our results.”

Download: Refresco reports Q2 2017 results

[1] Based on US GAAP.

[2] Based on US GAAP.

[3] Change percentages and totals calculated before rounding.