Australia: Fruit juice brands fighting for shrinking market (except for trend-buster Nudie)

Consumption of packaged fruit juice in Australia has been in freefall in recent years, with the latest findings from Roy Morgan Research showing that the number of Aussies who drink it in an average week has plummeted by 1.3 million people since 2012. So who’s still drinking juice and which brands are doing well in this shrinking market?

Consumption of packaged fruit juice in Australia has been in freefall in recent years, with the latest findings from Roy Morgan Research showing that the number of Aussies who drink it in an average week has plummeted by 1.3 million people since 2012. So who’s still drinking juice and which brands are doing well in this shrinking market? And where do juice bars fit in? Read on…

Consumption of packaged fruit juice in Australia has been in freefall in recent years, with the latest findings from Roy Morgan Research showing that the number of Aussies who drink it in an average week has plummeted by 1.3 million people since 2012. So who’s still drinking juice and which brands are doing well in this shrinking market? And where do juice bars fit in? Read on…

Back in June 2012, 6.6 million Australians aged 14 or older (35.2 % of the population) reported drinking packaged fruit juice in any given seven days, consuming an average of 4.6 glasses each. Fast forward to June 2016, and that figure had fallen to 5.3 million people (26.9 %) drinking an average 4.3 glasses each: fewer people drinking fewer glasses.

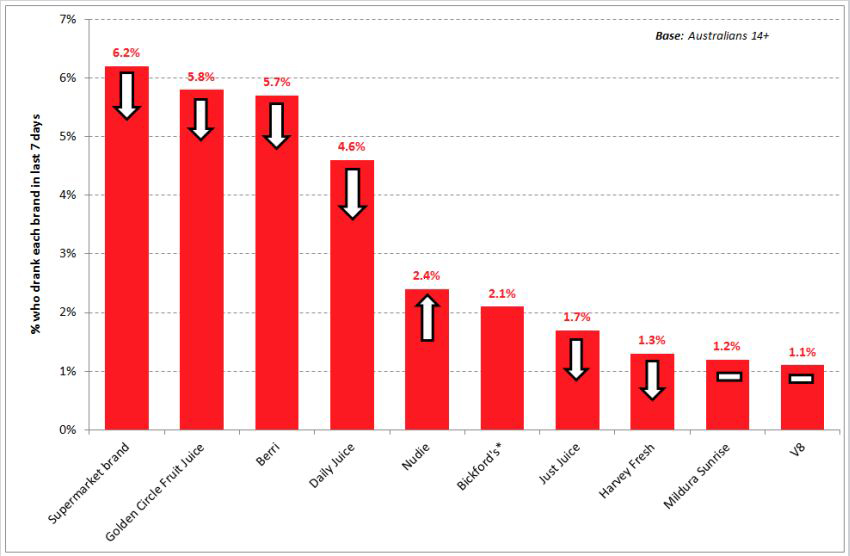

If we group all supermarket-branded juices together, they come out on top, more widely consumed than any of the big names. Some 6.2 % of the population drink them per week, narrowly ahead of Aussie institutions Golden Circle (5.8 %) and Berri (5.7 %). Daily Juice and Nudie complete the top five. However, only one of this juicy quintet has gained popularity since 2012: Nudie, which has seen its weekly consumption almost triple from 0.9 % to 2.4 % of the population.

Men (27.6 %) are slightly more likely than women (26.3 %) to consume packaged fruit juice, with young people of both genders being the most avid consumers. Among men, consumption peaks among 18-24 year-olds (34.6 %), while the 65+ bracket is least likely to drink it (25.5 %). Among women, 38.8 % of girls aged 14-17 consume fruit juice/drinks in an average seven days, putting them well ahead of other age groups – particularly women aged 65 or older, 19.9 % of whom partake.

Not surprisingly, supermarkets are the most common place for buying packaged fruit juice: just over 5.2 million Australians purchase it there in an average four-week period (although this figure, too, has declined from 5.6 million). In contrast, there has been a slight increase in juice-bar purchasers. Just over 1.8 million people agree that ‘I often buy drinks from juice bars’, up from just under 1.6 million.

The juice bar mentality

While Australia’s declining taste for packaged fruit juices is widely understood to be driven by growing awareness of the sugar contained in these beverages, Roy Morgan data suggests that juice from juice-bars does not have this stigma attached to it.

On the contrary: people who ‘often buy drinks from juice bars’ are markedly more likely than the average Australian to be concerned about their health, nutrition and weight. Compared with the population average, juice-bar customers are:

- 119 % more likely to ‘look for drinks with added ingredients that are good for my body’

- 104 % more likely to agree that ‘the food I eat is all, or almost all, vegetarian

- 96 % more likely to ‘buy drinks that boost my energy’

- 91 % more likely to ‘avoid dairy foods whenever possible’

- 54 % more likely to ‘try to avoid drinks that contain caffeine’

- 33 % more likely to ‘favour natural medicines and health products’

- 21 % more likely to agree ‘I’m constantly watching my weight’

- 20 % more likely to ‘always think of the number of calories in the food I’m eating’

Unlike packaged-juice drinkers, consumers of fruit-bar juices are more likely to be women than men. (It should be noted that women are also more likely to agree with most of the attitude statements above.)